Writing A Check In The Thousands

Guide on How to Write a Check

Even though digital payments are continually gaining more market share Total Addressable Market (TAM) Total Addressable Market (TAM), also referred to as total available market, is the overall revenue opportunity that is available to a product or service if , it's still important to know how to write a check. This guide will show you step-by-step how to fill out a check, with easy to follow diagrams and illustrations. Many businesses Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial institutions. , employers, and landlords still rely on checks to make payments.

Steps on How to Fill Out a Check

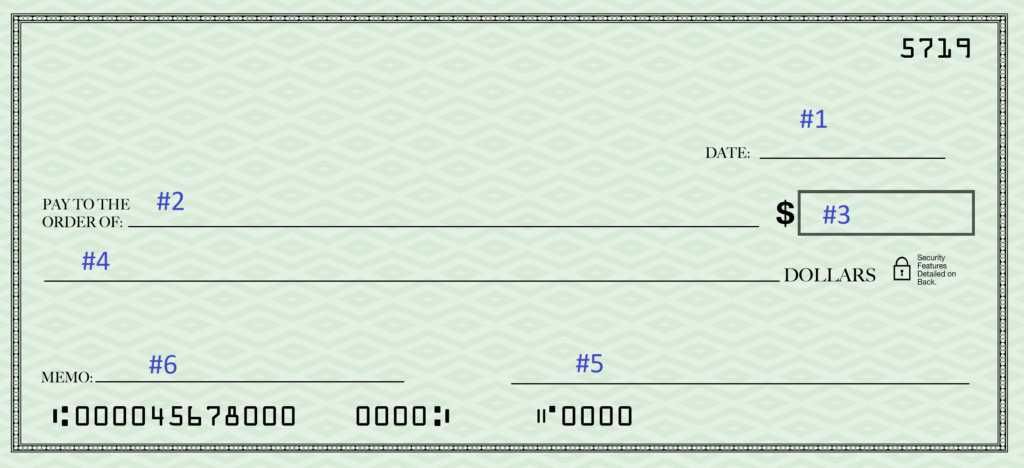

Below are the steps you will need to take to properly fill out a check:

1 – Write the date in the top right corner.

2 – Add the name of the recipient next to "Pay to."

3 – Write the value to be paid in numbers next to the "$" symbol.

4 – Write out with words (spell it out) the amount of the payment on the long line.

5 – Sign with your signature in the bottom right where it says "Per."

6 – Optional: Add a note where it says "memo" or "re:" in the bottom left corner.

Detailed Explanation of How to Write a Check

Let's explore each of the above steps in more detail. By the end of this guide, and after practicing a few times, you should find the process very easy and natural.

#1 Date

The first step is very easy. All checks contain a place to write the date in the top right corner, and it should be today's date (the date at the time of signing the check). Sometimes people will post-date by writing a future date. However, this has no impact, as the check becomes legal tender as soon as it is signed.

Example: "Jan 1, 2018"

#2 Name

The next logical step is to write the name of the person receiving the payment. The name can be an individual, a business (corporation), a trust, a school, or any entity that has a bank account to deposit funds into. Make sure you spell the name correctly; although, in practice, many banks will provide some leeway on spelling, nicknames, and abbreviations.

Example: "John Doe"

#3 Value (#s)

Next, on the right side of the check will be a place to write the cash value that the recipient will receive. Use numbers and write the full amount in dollars and cents.

Example: "$23,010.52"

#4 Value (in words)

It's usually easier to write the value in numbers first, and then in words. In this step, look at the value you wrote in numbers and spell it out in words. You usually only have to write out the dollar value – the cents can be written numerically.

Example: "Twenty-three thousand and ten dollars and 52 cents"

Alternately: "Twenty-three thousand and ten and 52/100 dollars"

#5 Signature

As the last step, add your signature after you're sure everything is correct. Sign just as you always do on any legal document. Most checks have a line to sign on.

Example: "/SIGNATURE/"

#6 Memo

This is an optional component of how to write a check. If you wish to add some additional information such as what the payment is for, you can add it here. There is usually a little amount of extra space on the bottom left corner.

Example: "January Rent Payment"

Completed Check

Below is an example of what the completed check should look like. Note, this is not a real check.

General pointers

Here are some important general pointers on how to write a check. In addition to the six steps above, you'll also want to carefully consider these points:

- Write as neatly as you can.

- Use printing instead of cursive, if possible. This is for purposes of clarity – it is easier to read print than it is to read script.

- If you make an error, write "void" on the check and start writing a new one.

- Ensure all spellings are correct.

- Double-check that you have the right recipient and the right value amount.

Additional resources

Thank you for reading this guide on how to write a check. CFI is a global provider of extensive training and career advancement for financial professionals. To learn more and advance your career, explore the additional relevant CFI resources below:

- Bank Reconciliation Bank Reconciliation A bank reconciliation statement is a document that compares the cash balance on a company's balance sheet to the corresponding amount on its

- Cover Letter Template Use this Cover Letter Template to Get an Interview! A cover letter can make or break a job application so it's critical to get it right. Whether your letter is being read by HR or the hiring manager directly, there are several important boxes you must tick. This guide provides a free cover letter template and explanation of what you need to know

- Data Room Data Room A data room is a secure place that is used to store privileged data, usually for legal proceedings or mergers and acquisitions transactions.

- Source Documents Source Documents The paper trail of a company's financial transactions are referred to in accounting as source documents. Whether checks are written to be

Writing A Check In The Thousands

Source: https://corporatefinanceinstitute.com/resources/knowledge/other/how-to-write-a-check/

Posted by: lopezprolent.blogspot.com

0 Response to "Writing A Check In The Thousands"

Post a Comment